Peerless Tips About How To Build A Swap Curve

F fe +θ=θ(6) in building the curve in the futures region, formula (4), along with the compounding conversion (6), is applied to each futures period independently, and piecewise forward rates.

How to build a swap curve. The short end of the forward curve (up to two years) is constructed using sofr future contracts (a liquid futures market reflecting the anticipated sofr on the settlement. The pair ibor index= %gbplibor|6m supplies the conventions of the floating leg index. Our white paper, swap curve building at factset:

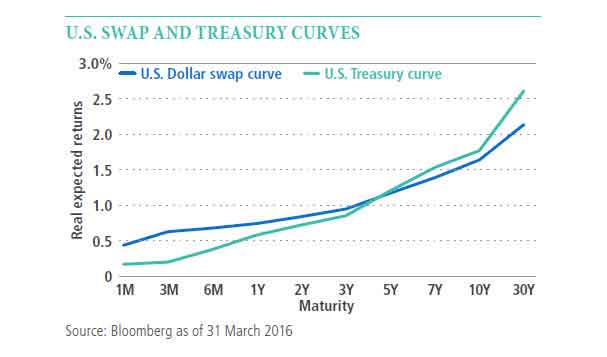

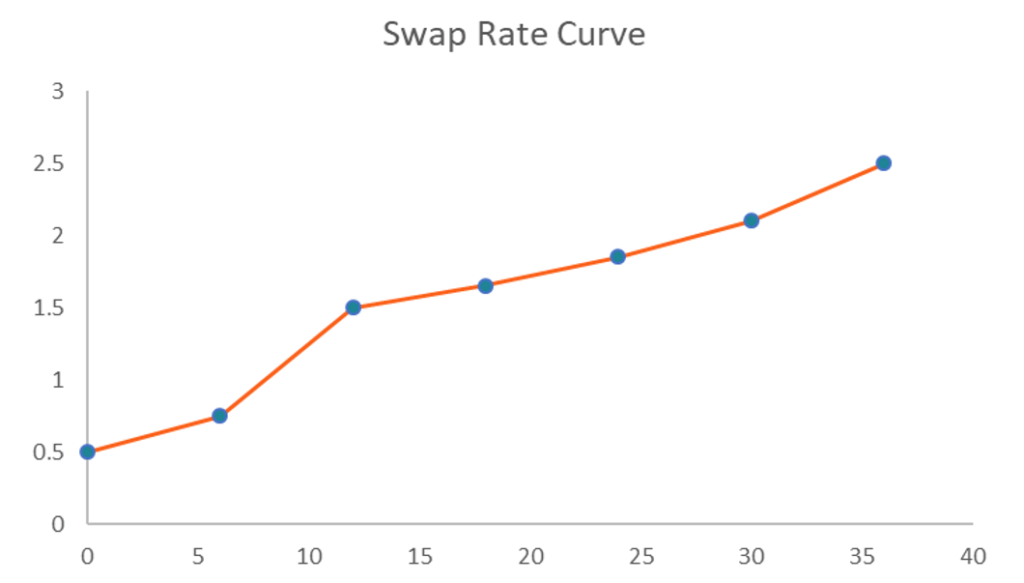

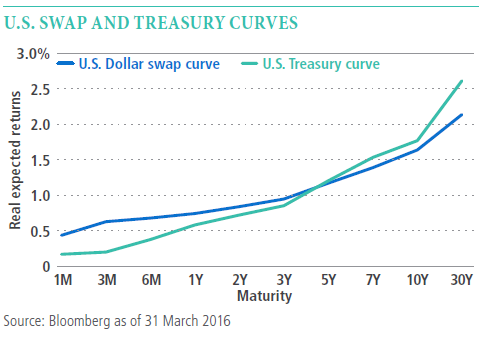

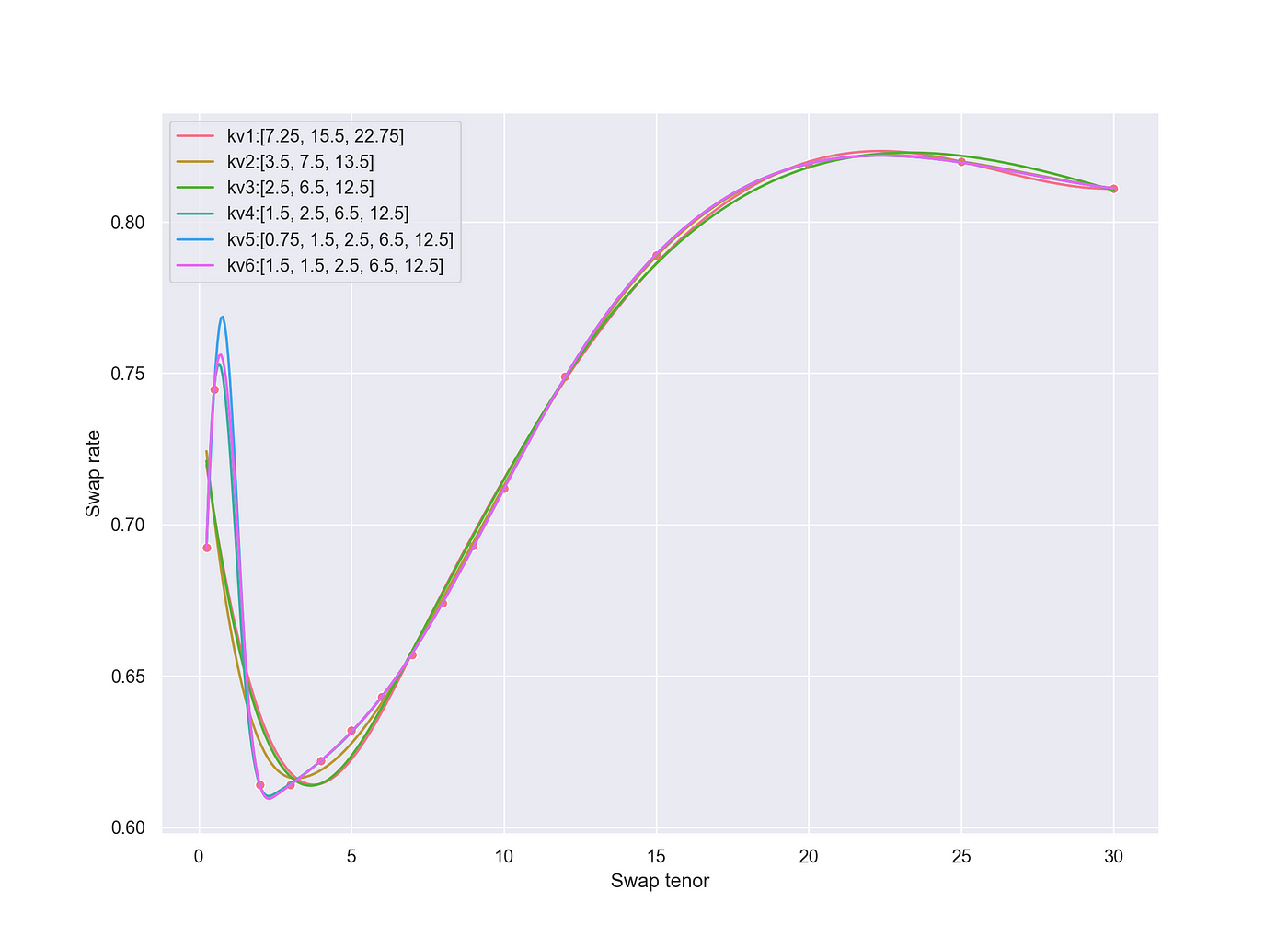

Notice, yield curve inversion in the front of the. A swap curve is constructed with deposits in the short end until 3m, ir futures in the middle until 2y, and with par swaps until 30 to 50y in the long end. Prior to the gfc, a single yield curve was the output of the process of curve construction.

V abstract the swap market has enjoyed tremendous growth in the last decade. Bootstrapping method is used to extract. Modified 2 years, 8 months ago.

A swap curve identifies the relationship between swap rates at varying maturities. A swap curve is the name given to the swap's equivalent of a yield curve. Far from a normal market environment, this made sterling rates an interesting asset class to analyse.

Ask question asked 2 years, 10 months ago. Curve building for a swap. With government issues shrinking in supply and increased price volatilities, the swap term structure has emerged.

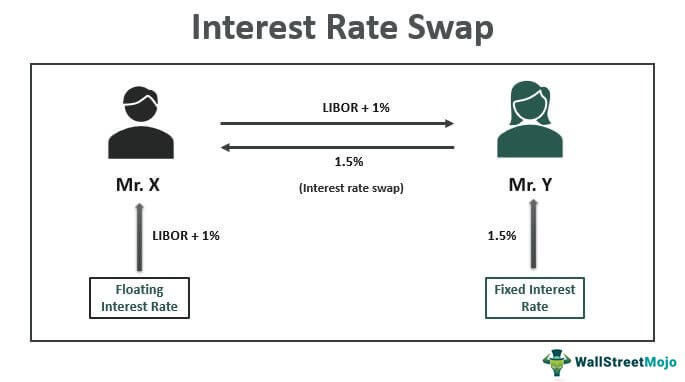

Viewed 221 times 2 1 $\begingroup$ i'm a student learning how to build a swap. Vanilla irs, where one party pays a fixed coupon.

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Value_Interest_Rate_Swaps_Sep_2020-05-ebe661886e084d879c91c96ab4cbf63b.jpg)

/dotdash_Final_How_to_Value_Interest_Rate_Swaps_Sep_2020-01-4b6f55263e5a41b091bded09d63da811.jpg)