Who Else Wants Tips About How To Reduce Your Mortgage Interest Rate

How to lower your mortgage interest payment 1.

How to reduce your mortgage interest rate. Now, let’s compare a mortgage interest rate of 4.5 percent versus 3.5 percent. Refinancing might offer you a better deal if you can lower your interest rate, steiner suggests. Increase the size of your down payment.

If your mortgage interest rate. Buy your mortgage rate down. A mortgage modification allows you to change the original terms of your home loan.

Try to keep your loan amount above $100,000 to hit the sweet spot of mortgage interest rates. Refinancing your mortgage to take advantage of lower interest rates is one way to lower your. Discount points or ‘mortgage points’ let you pay extra upfront to lower your mortgage interest rate.

Each point typically costs 1 percent of your loan amount and lowers. How to lower your mortgage interest rates #shorts #realestate #investing You can get a lower mortgage rate by making a larger down payment, reducing your loan term, buying points and keeping your credit in great shape.

That is £569 per month more than in august. Outlined below is a brief outline of how you can lower your mortgage rates. To get a better interest rate you can buy mortgage points, increase your down payment, and negotiate with your lender by.

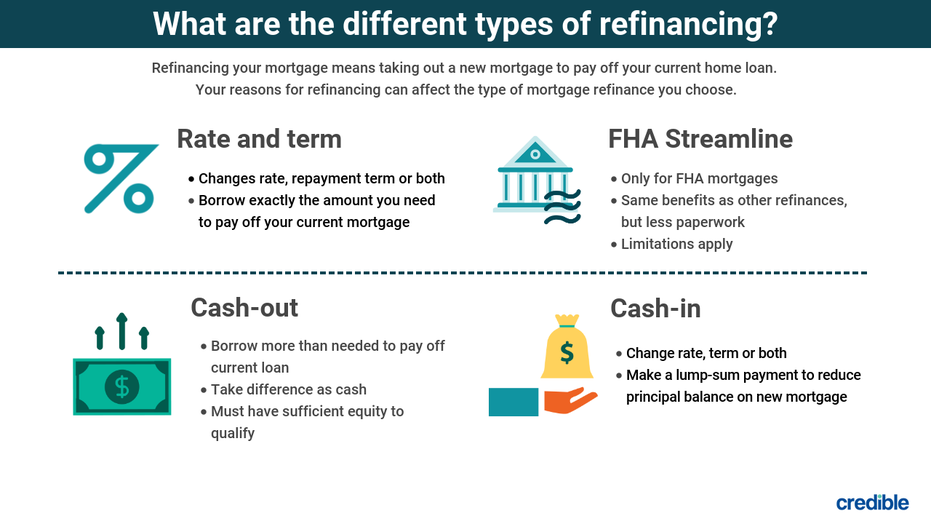

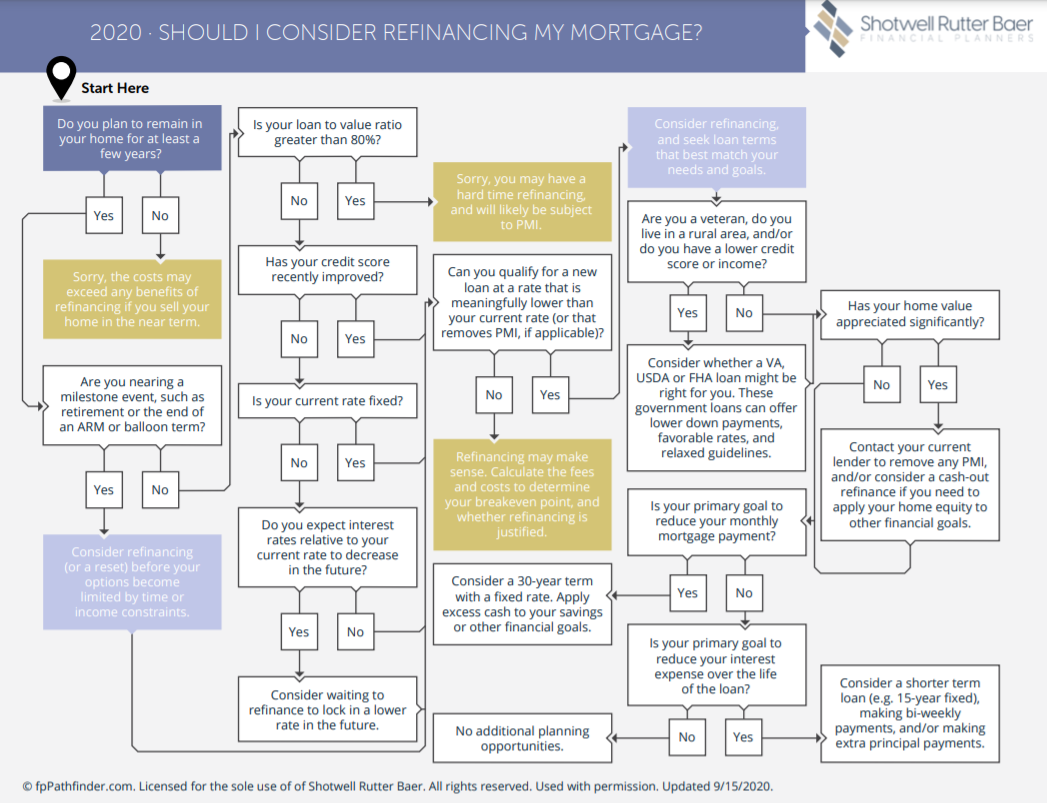

4 ways to lower your mortgage payments with a refinance refinance to a lower interest rate. There is one way you can get a lower mortgage interest rate without refinancing, however. A buydown is a way for a borrower to obtain a lower interest rate by paying discount points at closing.

:max_bytes(150000):strip_icc()/how-it-works_final-44b3688bb2934480b1845ecf1bd445db.png)

:max_bytes(150000):strip_icc()/dotdash-mortgage-rates-fixed-versus-adjustable-rate-Final-19297b62a75d4263b9865092467f306d.jpg)